Investing seems hard. This course makes it easy

Even if you've never invested a single penny before.

Learn to grow your wealth through investing on autopilot.

4-week investing crash course - £179

Imagine This 💬

✔️ You've taken action and started investing

✔️ You're growing your wealth each month

✔️ Your investment approach is automated, passive and optimised for your personal situation

✔️ You're on the path to becoming financially free and living life on your own terms

What You Can Expect:

#1

📺 Live Workshops

4 action-packed live workshops across 4 weeks, teaching you everything that you need to know about investing - simply and jargon-free.

You can watch the workshops back whenever you like and you'll have lifetime access to the recordings.

#2

🤝 1:1 Support

Time to finally get your pensions, ISAs and investments sorted - you will get 1:1 support from myself personally throughout the 4-weeks.

Any question you have, no matter how big or how small, I'll help you out.

#3

🌐 Community

A Whatsapp group that will be active daily, reinforcing key concepts and discussing investing.

You will be held accountable to keep you on track, taking the actions you need to and moving in the right direction across the 4 weeks.

'Will this course work for me?'

I believe so. 100%.

Whether you're a complete beginner and want to learn about investing so you can simply 'set it and forget it'.

Or you're already investing, want to improve your current approach and be meticulous on every single detail.

Whilst this isn't a get rich quick scheme and you won't retire overnight...

If you join the workshops and follow the steps, you’ll have the knowledge and tools (as well as 1-on-1 help from myself) to build long term wealth through investing.

So yes - it will work 🙌

But just in case:

The Money Back Guarantee 💷

If the workshops or course don't meet your expectations, let me know and I will give you a 100% refund.

I'm not here to take your money.

I want to genuinely help you and want this 4-week program to be useful for you.

Ready to get started?

Yes - I'm inHey, I'm Ryan 👋

8 years ago I had never invested a penny.

Now I have a £150,000+ investment portfolio.

My wealth grows on autopilot each month.

And my investing approach could not be simpler, easier or more passive. That's why I love it.

But I had no clue when I first started out, it took a lot of trial and error and I made a ton of mistakes.

I originally started Making Money Simple to break investing down simply and jargon-free.

Now this 4-week investing crash course takes that to the next level, teaching you absolutely everything that you need to know about investing.

Even if you've never invested a single penny before, you'll become a confident investor in 4 weeks.

You might currently think that to start investing:

👉 You need a lot of money

👉 You need a degree or financial advisor

👉 You need to look at stock charts all day

The truth is that these are all myths.

Combined with the fact that:

❌ Government support is dwindling

❌ Employer pensions are less generous

❌ Your savings are losing value due to inflation

Means that you need to take control and start investing.

Introducing... the only investing course you'll need to take.

Designed to teach you everything you need to know about investing - for yourself, your children, your family - to get you setup for life.

❌ No 'get rich quick' bullshit

✅ Comprehensive guide of exactly how to start investing

✅ The specific tools to build your wealth through investing

✅ Ongoing support to help you out and keep you accountable every step of the way

✅ Everything I've learned and put into practice myself will be available inside this course

Who Is This For?

✔️ You want to start investing, but don't know where to start and haven't taken the plunge yet

✔️ You feel overwhelmed and are struggling to cut through the jargon and sheer number of options

✔️ You're already investing, but want to understand how to improve your approach

✔️ You want your money to go further and start working for you

Keen to get involved?

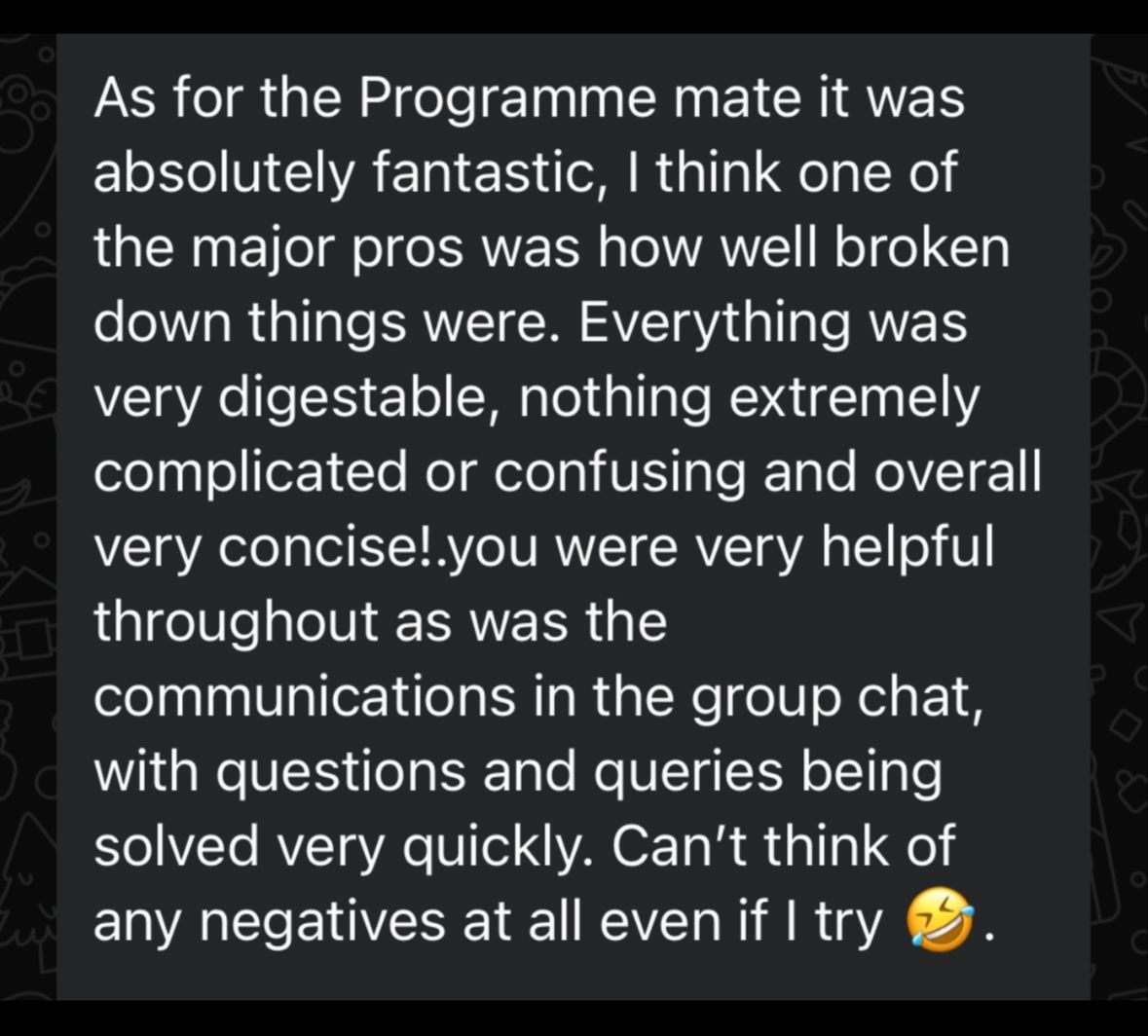

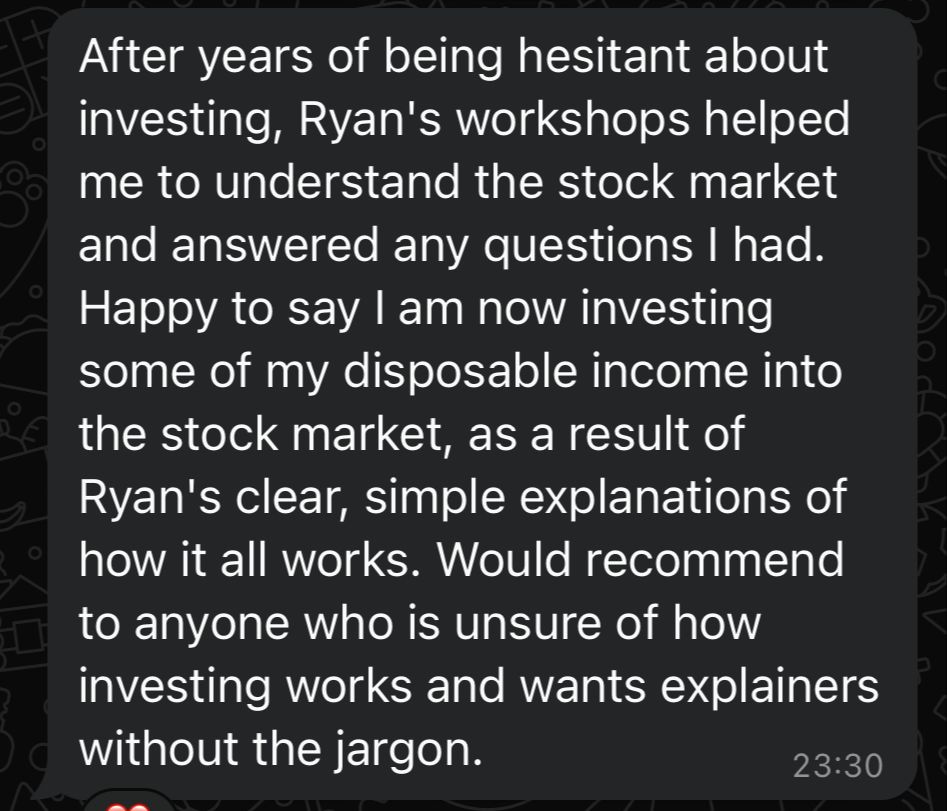

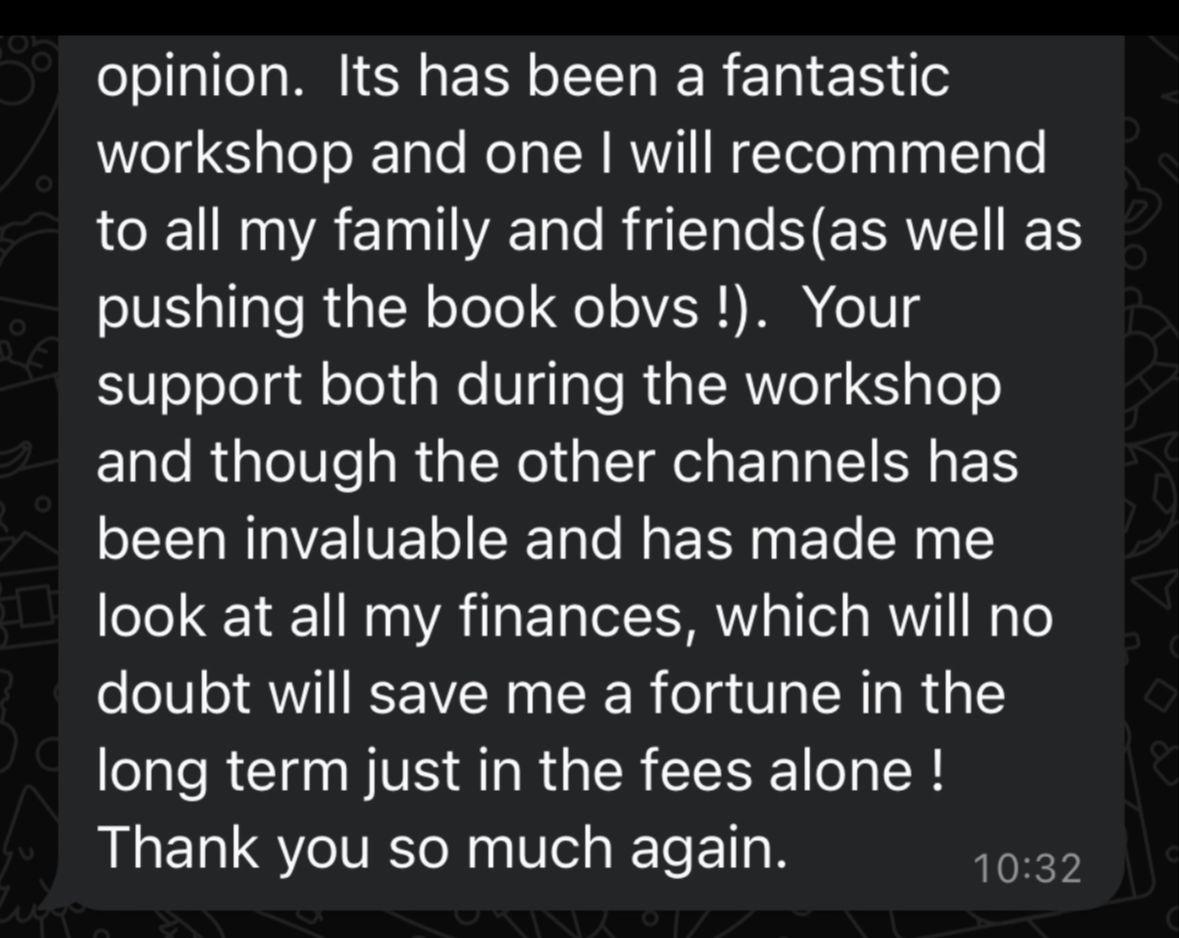

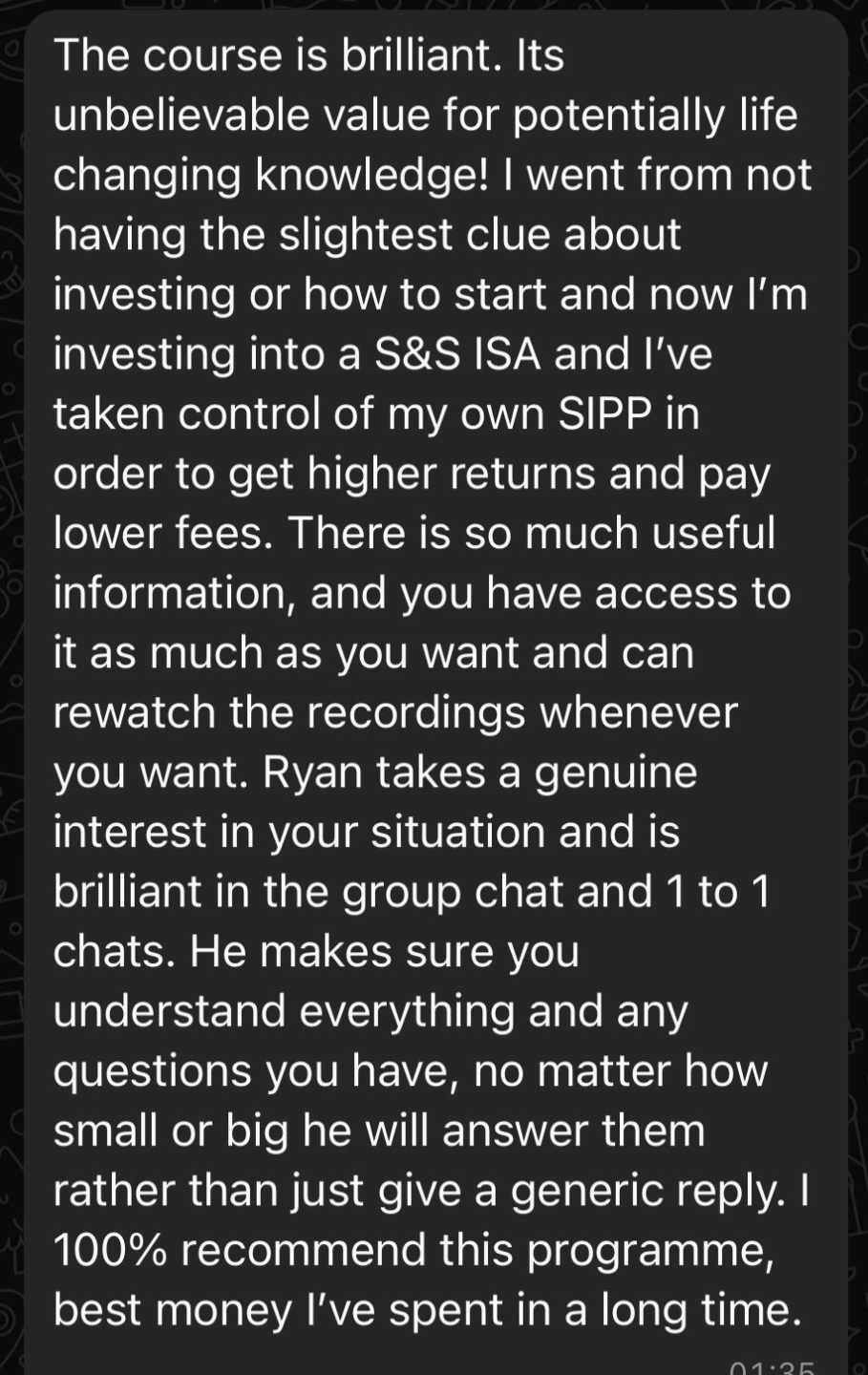

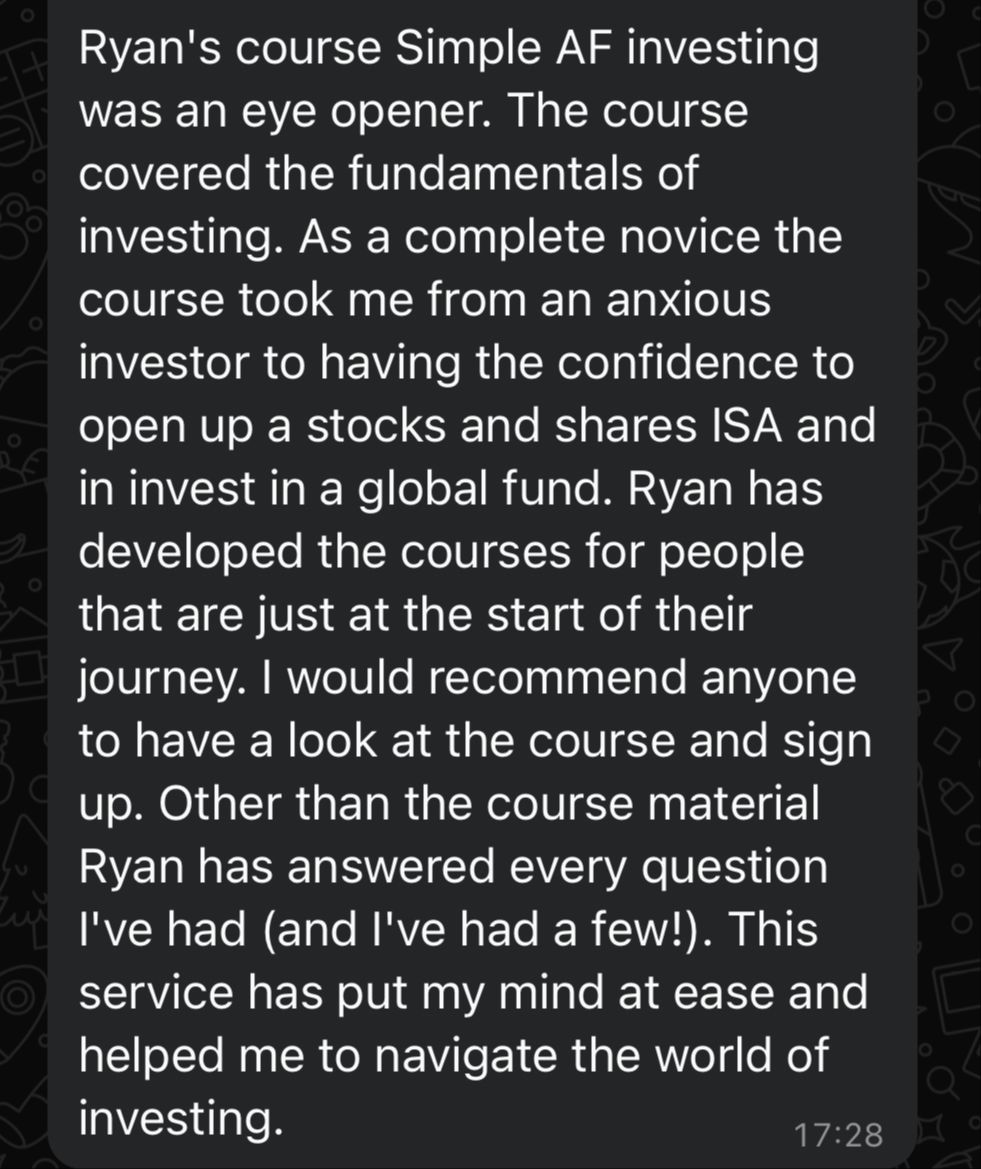

Sign me upWhat Did Previous Cohorts Say? 👇

What Exactly Do We Cover? 👇

Week 1 - The Foundations

Starting with the basics, let's lay the foundations for investing and the stock market.

Investing:

- 👉 Introduction to investing

- 👉 Why even bother investing?

- 👉 What can we actually invest into?

- 👉 The two ways we can make money with investing

- 👉 Common investing myths and misconceptions debunked

- 👉 What to consider before investing (risk tolerance, goals and more)

- 👉 What to actually do before investing

Stock Market:

- 👉 Introduction to stocks and the stock market

- 👉 How does the stock market actually work in practice?

- 👉 Stock market prices (and why they fluctuate)

- 👉 Different investing strategies (and their pros & cons)

- 👉 The best investing approach: Passive investing

- 👉 Everything you need to know about Index Funds and ETFs

- 👉 The holy grail - compound interest (and what returns can we actually expect?)

We will cover all of this and more in week 1.

Week 2 - The Investing Blueprint

Moving into the tools you need to actually invest, using the three-step blueprint.

1) Platform

- 👉 Choosing the best investment platform based on your specific situation

- 👉 The importance of low fees and how you can minimise them

- 👉 DIY platforms vs Robo-advisor platforms

- 👉 Platforms I'd recommend

2) Account

- 👉 The best investing accounts to use (Stocks & Shares ISAs and Pensions - including workplace pensions and SIPPs)

- 👉 The investing account to avoid (general investment account)

- 👉 Pros and cons of the different accounts

- 👉 The specific investing accounts to prioritise based on your specific situation (for sole traders, 9-5'ers and business owners)

- 👉 The importance of taxes and how you can minimise them

- 👉 Step by step guide showing how to actually open an account

- 👉 Main accounts I use (and which accounts I prioritise)

3) Investment

- 👉 Different investment options available (individual stocks, index funds, ETFs, bonds and more)

- 👉 Global index funds and ETFs

- 👉 US index funds and ETFs

- 👉 Lifestrategy funds and Target Date Retirement funds explained

- 👉 What to look for when choosing a fund

- 👉 How to analyse a fund

- 👉 How to allocate your money to 'risky' investments

- 👉 The exact approach that I follow and specific funds that I invest into

We will cover all of this and more in week 2.

Week 3 - Actually Investing

Applying it - actually getting started with investing, building confidence and calming any nerves by answering some key questions.

- 👉 Is now a bad time to invest?

- 👉 Market timing and market crashes

- 👉 Practical step by step investing guide (using the three-step investing blueprint)

- 👉 How making an investment actually works

- 👉 How to set up an automatic investment

- 👉 When should you start investing?

- 👉 How much to start with and how much to invest each month?

- 👉 What should you actually invest in?

- 👉 Lump sum invest or 'cost average' invest over time?

- 👉 Investing fees - what fees you will pay, how you pay them and how to reduce them

- 👉 Evaluating and rebalancing your investment portfolio

- 👉 Investing mistakes to avoid

We will cover all of this and more in week 3.

Week 4 - Everything Else + Q&A

The final session to cover more investing content, as well as a live question & answer session.

- 👉 Revisiting the key concepts

- 👉 The importance of Pensions

- 👉 Which ISAs to prioritise based on your specific situation

- 👉 How to invest for your children

- 👉 Investing into Crypto

- 👉 Invest or overpay mortgage?

- 👉 Sticking to the plan

We will cover all of this and more in week 4.

Plus a chance for a Q&A session to answer any questions in detail.

Ready?

Sign up nowFrequently Asked Questions

When does it start?

What is the time commitment?

What if I miss a workshop?

Do I need prior investing knowledge?

How much do I need to start investing?

What if I'm already investing?

What if I don't find it useful?

Still on the fence? That's understandable. Here's a few more past reviews👇